Urgent Message: Urgent care operators must navigate emerging federal, state, and payer regulations when developing financial policies that require payment by credit card and when setting fees for bounced checks and denied credit card charges.

Alan A. Ayers, MBA, MAcc

Citation: Ayers A. Guardrails for Nonsufficient Funds and Credit Card on File Fees. J Urgent Care Med. 2024; 18 (11): 41-43

Urgent care centers frequently charge a nonsufficient funds (NSF) fee when a patient’s check for copays or balances due has “bounced” (ie, has insufficient funds in their checking account to cover the check).

NSF fees are also frequently charged when a credit or debit card payment can’t be processed because the accountholder has insufficient credit or funds available. If their bill can’t be paid, or their check won’t clear, the transaction will not be approved. As a result, they are charged the fee due to insufficient funds.[1]

Regulators Increase Scrutiny on NSF Fees

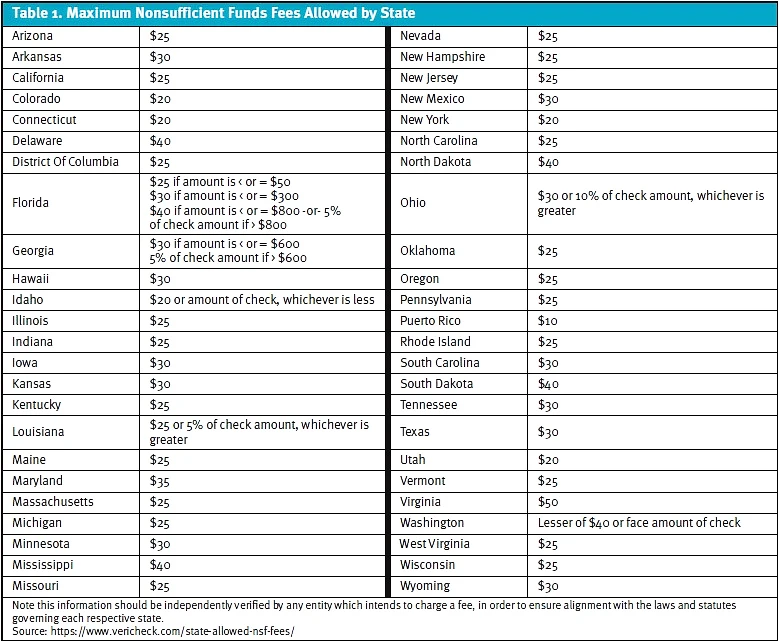

Pursuant to federal law, banks must disclose any fees they charge in connection with a deposit account.[2] For everyone else, whether a retail merchant or medical business, specific NSF fees are regulated by states. For example, in California[3], New Jersey, and many other states, the maximum charge is $25. Virginia’s maximum fee is $50.[4] The maximum charge is typically governed by a statute tied to a calculation of an annual percentage rate.[5] Table 1 lists NSF fees by state.

NSF fees are coming under greater scrutiny, especially in light of a proposed rule by the Consumer Fraud Protection Bureau that would prohibit NSF fees on transactions that are declined instantaneously or near-instantaneously (those declined with no significant perceptible delay after the consumer initiates the transaction).[6] This prohibition would cover transactions involving the use of debit cards, ATMs, or certain person-to-person apps. The proposed rule provides that charging these fees constitutes an abusive practice under the Consumer Financial Protection Act.6

A Minnesota federal district court dismissed the Minnesota Bankers Association’s and Lake Central Bank’s lawsuit challenging the FDIC’s supervisory guidance on NSF fees.[7] On February 22, 2024, California Attorney General Rob Bonta issued letters to California’s 197 state-chartered banks and credit unions cautioning that overdraft and returned deposited item fees may violate that state’s Unfair Competition Law and the federal Consumer Financial Protection Act.[8]

NSF Fees on Credit Cards

Most healthcare providers will accept credit cards as payment for medical services. Increasingly, urgent care centers will also ask a patient to provide a credit card at the time of service to cover any residual balance after the claim adjudicates, similar to how a hotel requires a credit card at registration to cover any incidentals like damage and theft.

But what if the credit on file declines due to insufficient available credit or because the account was closed? Such can result in the same amount of labor for an urgent care because a bounced check as what should have been a passive process of charging a card now requires the urgent care to pursue payment from the patient—whether by mailed statement or referral to a collections agency.

To cover this added cost, urgent cares may charge a fee if the credit card on file is declined when the insurance claim adjudicates. Federal regulations only restrict the amount that a credit card company can impose as a fee.[9]

But it is significant to note that medical debt is treated differently than credit card debt. If a patient misses a credit card payment, the card issuer can report the delinquent payment to the credit bureaus as soon as the debt is 30 days past due. However, medical debt won’t affect a patient’s credit score unless it’s sent to collections, is over $500, and remains unpaid for a year after the original delinquency date (the date the bill first became past due). When a patient puts his or her medical debt on a credit card, it becomes routine credit card debt. As such, the patient forfeits the yearlong grace period that medical debt has.[10] Plus, they lose the ability to negotiate a payment plan or reduced bill with the medical provider.[11]

Also, physicians can’t require patients to share their credit card information to receive medical care.[12] Moreover, if patients do share credit card information, physicians can’t keep or charge credit cards without a patient’s consent to do so for subsequent use.12 And while urgent care centers collect copays and patient balances at time of service, there may be other patient responsibility including co-insurance and deductibles that are unknown until after the visit. Some facilities may require the patient to present a credit card on file to assure it receives payment for these residual patient balances after the insurance claim adjudicates. However, it’s important to remember that credit card information is considered protected health information under HIPAA when maintained by a healthcare provider.

There are no clear requirements that physicians must follow to guarantee compliance with HIPAA in the storage of patient credit card information, but HIPAA’s Security Rule states the “reasonableness” of the security measures in place while also setting forth minimum security standards to which a provider such as an urgent care must adhere.[13]

Medicare ‘Assignment’

Another wrinkle to this issue is the fact that a patient can see the lowest cost if the health care provider accepts the Medicare-approved amount as full payment for a covered service. This is known as “accepting assignment.” If a provider accepts assignment, it’s for all Medicare-covered Part A and Part B services.[14] Further, Medicare is clear that fees charged to patients above and beyond what is allowed based on the fee schedule are prohibited.[15] The Department of Health and Human Services’ Office of Inspector General stated in March 2004 that charging extra for services covered by Medicare constituted a potential assignment violation and may be subject to civil monetary penalties.[16]

Any fees, including interest or statement fees, are deemed beyond Medicare’s deductible and coinsurance. Additional administrative costs are to be absorbed by the practice. The only exception is a charge for missed appointments (which typically doesn’t apply to urgent care), which must be consistent with all patients.16

Private health insurance contracts likewise require providers to accept only the contracted amount as payment in full so the addition of fees begs the question of whether a provider is requiring payment above and beyond the assignment. It is for this reason that many opine that an urgent care cannot add surcharges to cover credit card processing costs.

Summary

Urgent care owners and operators should be aware of and stay up-to-date with the changes in NSF fee laws. In addition, a number of states are considering the elimination of such fees, and much could charge if the proposed rule by the Consumer Fraud Protection Bureau prohibiting NSF fees is promulgated.

References

- [1]. Dan Avery, What Are NSF Fees and Why Do Banks Charge Them? CNET (updated on September 28, 2023). Retrieved at https://www.cnet.com/personal-finance/banking/advice/what-are-nsf-fees-and-why-do-banks-charge-them/..

- [2]. Overdraft and Account Fees, FDIC Consumer News (December 2021). Retrieved at https://www.fdic.gov/resources/consumers/consumer-news/2021-12.html.

- [3]. See, e.g., Johnson v. Flagstar Bank, N.A., No. EDCV 23-1626-KK-SPx, 2024 U.S. Dist. LEXIS 11219, at *2 (C.D. Cal. Jan. 22, 2024)

- [4]. State Allowed NSF Fees, VCI. Retrieved at https://www.vericheck.com/state-allowed-nsf-fees/.

- [5]. For example, Minnesota Statute § 48.185(3)

- [6]. Proposed rule, Nonsufficient Funds (NSF) Fees for Instantaneously Declined Transactions, Consumer Fraud Protection Bureau (January 24, 2024). Retrieved at https://www.consumerfinance.gov/rules-policy/rules-under-development/nonsufficient-funds-nsf-fees/#:~:text=When%20a%20consumer%27s%20attempted%20withdrawal,nonsufficient%20funds%20(NSF)%20fee. The text of the proposed rule is found at https://www.federalregister.gov/documents/2024/01/31/2024-01688/fees-for-instantaneously-declined-transactions#:~:text=to%20this%20definition.-,2(e)%20Nonsufficient%20Funds%20Fee%20or%20NSF%20Fee,account%20due%20to%20insufficient%20funds.

- [7]. Minn. Bankers Ass’n v. FDIC, No. 23-2177 (PAM/ECW), 2024 U.S. Dist. LEXIS 63599, at *2 (D. Minn. Apr. 8, 2024). See Minnesota federal court dismisses Minnesota Bankers Association’s NSF fees lawsuit, ABA Banking Journal (April 30, 2024). Retrieved at https://bankingjournal.aba.com/2024/04/minnesota-federal-court-dismisses-minnesota-bankers-associations-nsf-fees-lawsuit/.

- [8]. Press release, Attorney General Bonta Issues Warning to Small Banks and Credit Unions: Surprise Overdraft and Returned Deposited Item Fees Harm Consumers, Office of the California Attorney General (February 22, 2024). Retrieved at https://www.consumerfinancemonitor.com/2024/02/27/california-ag-issues-warning-to-state-chartered-banks-and-credit-unions-on-surprise-overdraft-and-returned-deposit-item-fees/.

- [9]. See 12 CFR § 1026.52(b)(1)(ii).

- [10]. Effective July 1, 2022, paid medical collection debt is no longer included on U.S. consumer credit reports. Can Medical Collection Debt Impact Credit Scores? Equifax. Retrieved at https://www.equifax.com/personal/education/credit/score/articles/-/learn/can-medical-debt-impact-credit-scores/#:~:text=Effective%20July%201%2C%202022%2C%20paid,on%20U.S.%20consumer%20credit%20reports.

- [11]. Erik J. Martin, Should I Put Medical Bills on a Credit Card? Bankrate (October 26, 2023). Retrieved at https://www.bankrate.com/credit-cards/advice/should-i-put-medical-bills-credit-card/#:~:text=%E2%80%9CMost%20medical%20bills%20are%20allowed,processing%20fees%2C%E2%80%9D%20says%20Lynch.

- [12]. Mary K. Pratt, Pros and Cons of Keeping Patient Credit Cards on File, Medical Economics (February 25, 2018). Retrieved at https://www.medicaleconomics.com/view/pros-and-cons-keeping-patient-credit-cards-file.

- [13]. Summary of the HIPAA Security Rule, HHS, Retrieved at https://www.hhs.gov/hipaa/for-professionals/security/laws-regulations/index.html#:~:text=The%20Security%20Rule%20protects%20a,%22%20(e%2DPHI), citing 45 C.F.R. § 160.103. See also HIPAA Security Rule & Risk Analysis, AMA. Retrieved at https://www.ama-assn.org/practice-management/hipaa/hipaa-security-rule-risk-analysis; Patient Credit Card Info, Scott Roberts Law. Retrieved at https://scottrobertslaw.com/business-and-real-estate-law/patient-credit-card-info/.

- [14]. Does Your Provider Accept Medicare as Full Payment?, Medicare.gov. Retrieved at https://www.medicare.gov/basics/costs/medicare-costs/provider-accept-Medicare.

- [15]. Charging Convenience Fee, American Academy of Ophthalmology (June 17, 20249, 2023). Retrieved at https://www.aao.org/practice-management/news-detail/charging-convenience-fee.

- [16]. Charges for Missed Appointments, § 30.3.13, CMS Manual System: Pub 100-04 Medicare Claims Processing, Department of Health & Human Services (June 29, 2007). Retrieved at https://www.cms.gov/files/document/r1279cppdf#:~:text=%2D01%2D07)-,CMS%27s%20policy%20is%20to%20allow%20physicians%20and%20suppliers%20to%20charge,Medicare%20patients%20for%20missed%20appointments

Download the article PDF: Guardrails for Nonsufficient Funds and Credit Card on File Fees