Urgent message: De novo growth of urgent care continued through the pandemic. As COVID turns endemic, investors remain bullish on urgent care growth.

Alan A. Ayers, MBA, MAcc

Despite concerns about fluctuating visit volumes and long-term sustainability, uncertainty and urgent care have always gone hand in hand. Case in point: Largely driven by flu, the urgent care industry has firsthand insight into years of flu research, seasonal trends, and vaccine efficacy. Yet amid everything we already know about the flu, each flu season arrives under a cloak of uncertainty.

Financial statements provide evidence of this unpredictability. If you look at historical financial statements for any urgent care over a stable multiyear period before the pandemic, you’ll find both strong and weak years, revenue-wise. While the statements themselves offer little insight into revenue swings between one year and the next, established owners will tell you why: “It’s impossible to predict the severity of the flu.”

The same principles of uncertainty hold true for COVID. While we know COVID is here to stay, we can’t predict every new variant, its scope of severity, or when it will spread. As ongoing waves of panic and restrictions subside for good, urgent care is well-positioned as the leading healthcare setting for all upper respiratory symptoms, including flu and COVID.

Post-COVID drop-offs in demand, coupled with wage inflation and fixed payer contracts, have become common concerns for urgent care providers in the COVID era. So…should we expect volume levels to plummet when the world shifts back to normalcy? The short answer is, No.

Industry Growth Opportunities of Today Will Remain Tomorrow

As of the writing of this article, urgent care is at 2019 levels, and the summer months are typically off season. So while we’re seeing a dramatic fall-off from the Omicron spikes earlier this year, metrics indicate an overall return to “normalcy.”

Even before the pandemic, roughly 80-85% of urgent care visits were, and continue to be, upper respiratory in nature. While a lot of reported urgent care visits throughout the pandemic involved COVID tests for respiratory concerns, the visit itself wasn’t necessarily COVID-related. Some estimates even suggest that only a third of urgent care visits in 2021 were driven solely by COVID.

Up to 80% of patients who were classified as “COVID” most likely would have been seen anyway in past years for flu, strep, RSV and other concerns.

Indeed, the impact of COVID is overstated in some capacities, as are the concerns about post-COVID volume declines. We also expect the “floor” of visits to rise as there’s now a “second flu” circulating. With COVID antiviral medications like Paxlovid (nirmatrelvir tablets; ritonavir tablets, Pfizer) and monoclonal antibody treatments now readily available, urgent care providers can both test and treat patients who experience COVID symptoms. As vaccine efficacy and heard immunity wanes, COVID will continue and the “ideal” urgent care visit might entail a 3-in-1 test for influenza, RSV, and COVID for every patient with viral respiratory concerns.

Another consideration pointing to sustained patient volumes is the impact of widespread hygiene practices adopted during the pandemic, which reduced herd immunity for common viruses like the flu. This indicates that the flu will become more virulent in the coming years. So, whether it’s the flu, COVID, strep throat, or similar symptoms, communities will continue to rely on urgent care services for trusted, accessible upper respiratory care. Revenue-wise, we expect these sustained traffic levels will be akin to year-round flu seasons over the coming years.

On average, urgent care centers saw a 25% increase in usership through the duration of the pandemic. Retention of first-time pandemic users at 66% is similar to pre-pandemic first-time users at 75%. Effective re-marketing is required to retain patients introduced to UC during the pandemic.

Bullish Investments Point to Sustained Profitability and Growth

If institutional and private investors learned anything during the pandemic, it’s that “discretionary” consumer businesses such as casinos, dining, and entertainment are vulnerable not just to changing economic winds—factors like inflation, fuel prices, unemployment—but can be completely shut down in a crisis. As a result, those types of investments have fallen out of favor with investors, replaced by those offering steady cash flows and proven resilience.

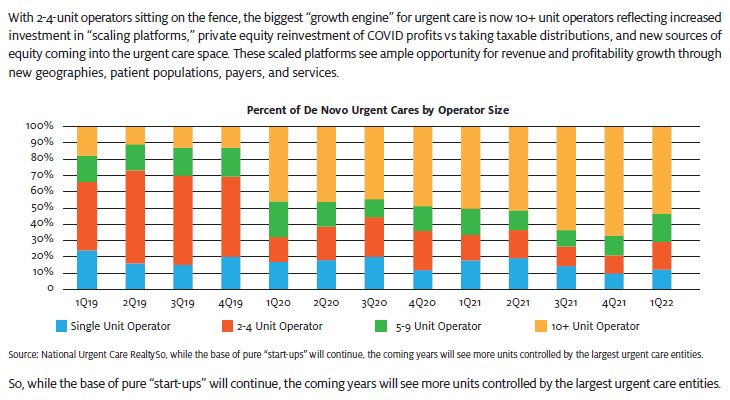

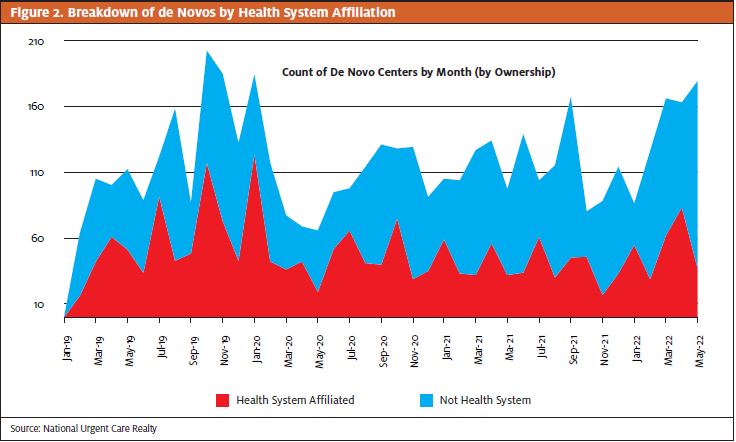

Thus, we continue to see “smart money” injected into urgent care by private equity firms, family offices, and institutions seeking high-quality platforms through de novos and fill-in acquisitions. Healthcare systems are also building out urgent care on local levels—either on their own or in joint ventures with private equity partners—which further indicates a sustained recognized value of urgent care across the broader healthcare ecosystem.

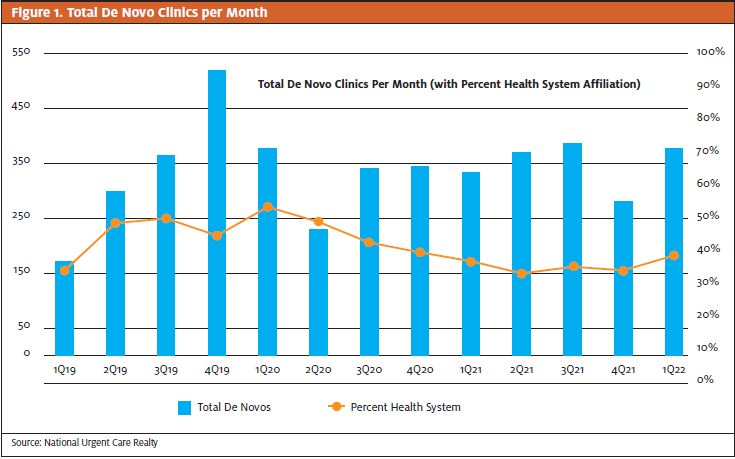

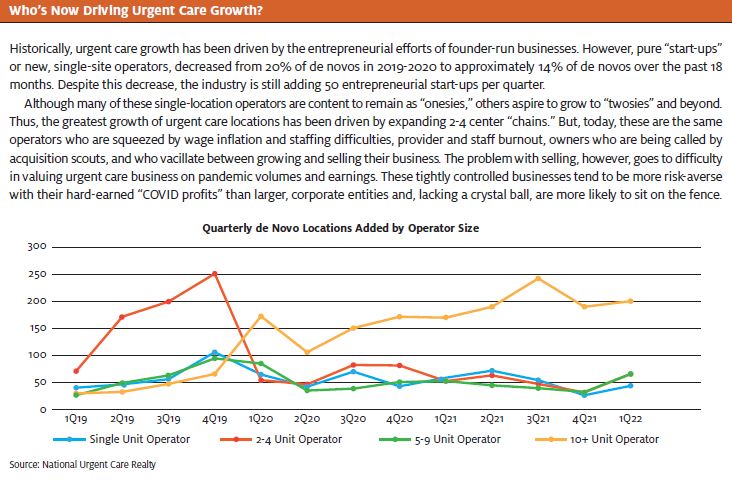

Indeed, urgent care has grown at a steady pace, adding approximately 350 centers per quarter, 42% of which are health system affiliated (see Figure 1 and Figure 2), according to National Urgent Care Realty. We only saw declines in opening during the busiest months of the Alpha, Delta, and Omicron waves, in which centers struggled with hiring and staffing. Given the greatest expense of a new center is working capital to fund operating losses until break-even volumes are attained—opening to the high demand of COVID enabled centers to break even almost immediately.

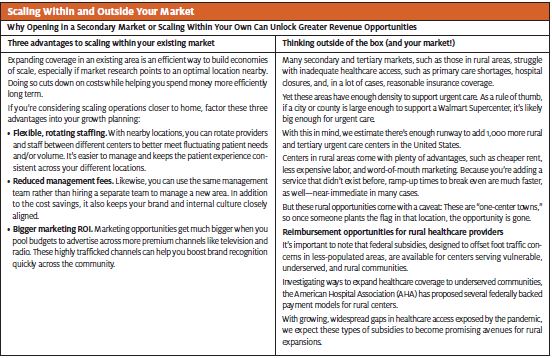

More than steady cash flow and economic resilience, urgent care remains a beacon of opportunity and growth. Reaching new populations through geographical expansions and new audiences represents a critical growth driver for urgent care. Growing at a rate of approximately 7% between 2013 and 2020, we expect future growth to continue at historic levels for the foreseeable future.

While some of the more suburban markets may appear oversaturated with competition, the urgent care industry hasn’t yet reached a point of national maturity. On the contrary, it remains early in its consumer adoption curve. It’s estimated that a third of the U.S. population—100 million people—have yet to even visit an urgent care location. In many cases, this is because they simply haven’t experienced an urgent medical issue. In others, it comes down to accessibility, insurance coverage, or both.

Inadequate healthcare access is a well-known struggle for rural populations—exposed cracks that have deepened and widened throughout the course of the pandemic. These secondary and tertiary markets are naturally prone to more primary care, hospital, and healthcare shortages and coverage despite carrying enough population density to warrant healthcare access and services.

Casting the net even wider, adding new payers is another opportunity to promote, elevate, and grow industry awareness among populations such as Medicaid and Medicare patients. Medicaid patients often drive much of the nonemergent use of ERs, which means that urgent care can offer tangible cost savings to Medicaid programs.

While it’s true that lots of folks will continue to favor their primary care providers, today’s reality is that it’s unusual to secure appointments with the same provider on a timely or regular basis. As baby boomers are aging into Medicare, we’ve seen many states expand and privatize Medicaid, which translates to millions more newly insured patients. Medicaid and Medicare patients, who tend to be far less exposed to urgent care than those in more commercial populations, stand to benefit greatly from the convenience, affordability, and easy healthcare access that urgent care provides.

Conclusion

Urgent care providers have even more opportunities post-COVID, both testing and treating patients experiencing symptoms. Investors remain attracted to urgent care’s steady cash flows and proven resilience, continuing to invest significantly in high-quality platforms. Expanding geographically and reaching new populations are additional growth drivers for the industry.

Author affiliations: Alan A. Ayers, MBA, MAcc is President of Experity Networks and is Senior Editor of The Journal of Urgent Care Medicine. The author has no relevant financial relationships with any commercial interests.

Read More

- Pandemic Woes Haven’t Dampened The Outlook For Urgent Care Growth

- Why Private Equity And Other ‘Smart Money’ Is Bullish On Brick-And-Mortar Urgent Care