Urgent message: CMS offers stimulus funds to providers who “attest” that their EHR use improves patient care: up to $18,000 in 2011 alone. The sooner you do, the more you stand to earn.

Eric McDonald, CEO of DocuTAP

“Meaningful use” refers to the use of a “certified” electronic health record (EHR) to meet specific objectives established by the Centers for Medicare & Medicaid Services (CMS), which administers the EHR incentive program. An EHR is certified when it demonstrates that it can perform certain functions mandated by CMS, such as electronic prescribing, computerized order entry, and the electronic exchange of clinical information (eg, problem lists, medication lists, allergies and diagnostic test results) to providers of care and patient-authorized entities.

For use to be considered meaningful, however, it is not enough for an EHR to offer the CMS-approved functionality. A medical practice must actually employ this functionality in its EHR to meet specific performance targets set by CMS, it must “attest” that it has done so, and it must meet these goals by specific dates to qualify for stimulus funds.

What are these goals and dates, and how much money is at stake? Let’s take a look.

Qualifying for Meaningful Use

You can qualify for meaningful use in one of two ways: by participating in either the Medicare or the Medicaid reimbursement program. You can’t participate in both programs at once. Important differences between the two include eligibility and incentive payments.

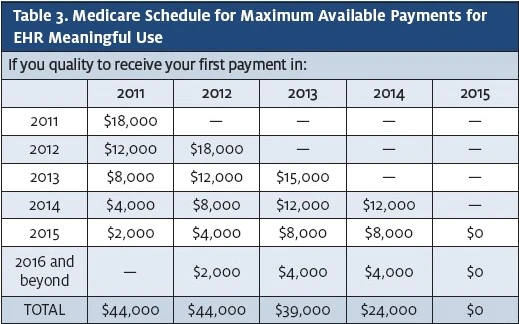

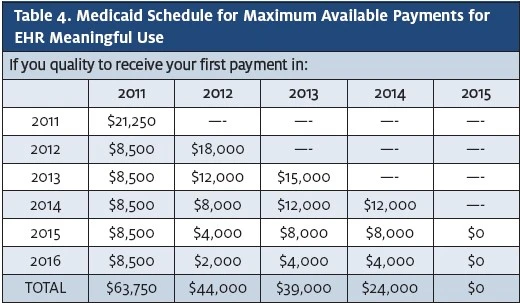

Participation in the Medicare program is open to MDs and DOs and provides a maximum incentive of $44,000 per provider over five years. Participation in the Medicaid program is also open to nurse practitioners and, in some cases, physician assistants (among other providers) and provides a maximum incentive of $63,750 per provider over six years, including up to $21,250 for the adoption and implementation of a certified EHR. In both the Medicare and Medicaid programs, incentive payments decrease each year, so the longer you wait to adopt a certified EHR—or use one you already have to achieve meaningful use goals, the less you stand to earn. In addition, Medicare-eligible providers who do before selecting this measure. On the other hand, clinics that already submit immunization or health surveillance data to state registries may consider selecting one or both of those measures to submit the same data to CMS (in the case of Medicare patients) via the EHR.

What Does “Attest” Mean?

Medicare-eligible professionals must attest to meaningful use through CMS’s web-based Registration and Attestation System, available at:

https://ehrincentives.cms.gov/hitech/login.action. Providers fill in numerators and denominators for the meaningful use objectives and clinical quality measures (which a certified EHR will be able to generate), indicate whether they qualify for exclusions to specific objectives, and legally attest that they that they have successfully demonstrated meaningful use.

As soon as you enter that data into the online Attestation System, you will see a summary of your attestation and whether it was successful. The Attestation System for the Medicare EHR Incentive Program went online on April 18, 2011. For the Medicaid EHR Incentive Program, providers follow a similar process using their state’s Attestation System. The states’ scheduled launch dates for their Medicaid EHR Incentive Programs are available at: www.cms.gov/apps/files/medicaid-HIT-sites.

To attest for the Medicare EHR Incentive Program in your first year of participation, you will need to have met meaningful use for a consecutive 90-day reporting period. If your initial attestation fails, you can select a different 90-day reporting period that may partially overlap with a previously reported 90-day period. To attest for the Medicare EHR Incentive Program in subsequent years, you will need to have met meaningful use for a full year.

Under the Medicaid EHR Incentive Program, providers can attest that they have adopted, implemented, or upgraded certified EHR technology in their first year of participation to receive an incentive payment. Medicaid EHR Incentive Program participants should check with their state to find out when they can begin participation.

However, any provider attesting to receive an EHR incentive payment for either the Medicare or the Medicaid EHR Incentive Program may be subject to an audit. Providers should therefore retain all relevant supporting documentation used to complete the Attestation Module responses. Documentation to support the attestation should be retained for six years post- attestation. Documentation to support payment calculations (such as cost report data) should continue to follow current documentation retention processes.

CMS and its contractors will perform audits on Medicare providers. The states and their contractors will perform audits on Medicaid providers. CMS and the states will also manage appeals processes. If, based on an audit, a provider is found to not be eligible for an EHR incentive payment, the payment will be recouped.

How the Payment Schedules Work

Participants in the Medicare program can receive a maximum of $44,000 over five years. Participants in the Medicaid program can receive a maximum of $63,750 over six years. Distribution payments are made according to schedules established by CMS (Table 3 and Table 4).

Important differences in incentive payments exist between the two programs. For the Medicare program not successfully demonstrate meaningful use by 2015 will have their Medicare reimbursement reduced. The reduction starts at 1% and increases each year that meaningful use is not demonstrated, up to a maximum of 5%.

To participate in the Medicaid program, adopting a certified EHR, and using it to meet the meaningful-use goals by the deadlines established by CMS, are not suf- ficient. To qualify for stimulus funds, at least 30% of a provider’s patients (by volume, not by charges) must be Medicaid patients. The Medicare program does not have a corresponding requirement for Medicare patients.

You can’t participate in both programs simultaneously. However, once a provider (referred to as an “eligible professional” for the purposes of qualification) selects one program, he or she is allowed to switch to the other program but only once.

Demonstrating Meaningful Use

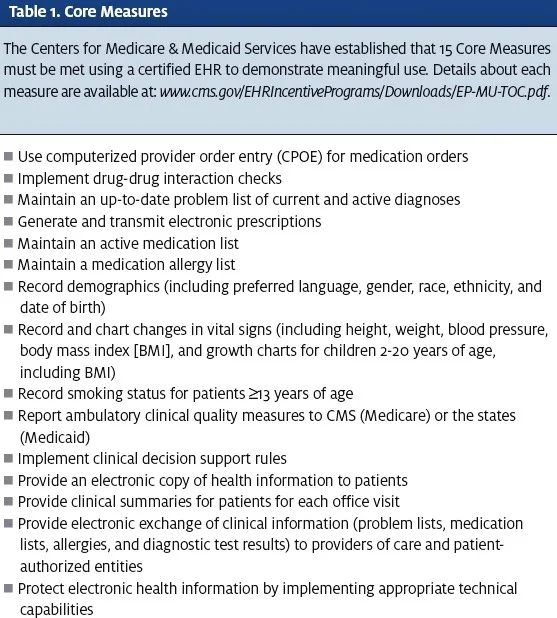

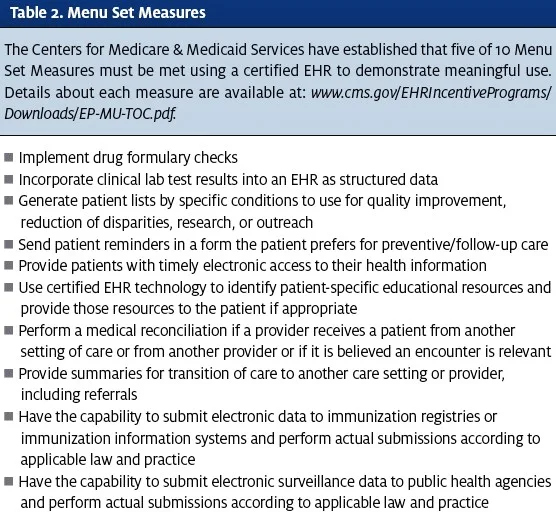

To demonstrate meaningful use, a provider must attest to meeting each of 15 Core Measures (Table 1) and five of 10 Menu Set Measures (Table 2).

Each Core Measure is accompanied by a percentage-based measure as a threshold for meeting that require- ment. For example, you must main- tain an active medication list for at least 80 percent of your patients.

Many of the measures are self- explanatory. Recording a patient’s demographics, vital signs, and smoking status, for example, while maintaining a list of that patient’s diagnoses (problem list), medications, and medication allergies is pretty simple. However, some measures may require additional explanation. For example, providers are required to report information on clinical quality measures, such as how often patients were queried about their smoking status, and, if applicable, offered cessation counseling, or how often hypertensive patients have had their blood pressure checked.

Beyond the clinical quality measures, providers must demonstrate the ability to implement a real-time clinical decision support rule related to a patient’s diagnosis, medication use, allergy, or lab test result.

A number of the core measures focus on the provision of health information (electronic or otherwise) to patients or other parties, such as primary care providers, and the ability of the system to protect patient health information when transmitting it through password protection and data encryption.

Remember, all 15 Core Measures must be met to attest to meaningful use.

As for the Menu Set Measures, a provider needs to attest to meeting the requirements of only five of 10. Selecting which five measures to meet may depend on the provider’s or clinic’s preferences, on whether there are additional costs associated with any of the features required, or even on whether the functionality involved is easy and practical to use.

For example, a clinic not using a lab interface would not be likely select the clinical lab test requirement, or would at least consider the cost of interface design

payments are calculated at 75% of the total allowable Medicare charges for each provider. Thus, in order for a provider to receive the maximum first-year payment of $18,000, he or she would need to have billed at least $24,000 in Medicare charges. For the Medicaid pro- gram, payments are calculated at 85% of the cost of the EHR, up to a maximum of $8,500 paid per year follow- ing implementation.

The total incentives of $44,000 (Medicare) and $63,750 (Medicaid) represent not only the maximum total payment available to each provider, but this money is available only to providers who attest to demonstrating meaningful use as early as 2012. Each year thereafter, the maximum available incentive payment for each program is reduced.

Incentive payments for the Medicare EHR Incentive Program will be made approximately four to eight weeks after an eligible professional meets the program requirements and successfully attests that he or she has demonstrated meaningful use of certified EHR technology. CMS began making Medicare incentive payments in May 2011. Payments will be held for eligible professionals until the eligible professional meets the $24,000 threshold in allowed charges. Medicaid incentives will be paid by the states and are also expected to begin this year. States are required to issue incentive payments within 45 days of providers successfully attesting to having adopted, implemented, or upgraded certified EHR technology during their first year of participation in the Medicaid EHR Incentive Pro- gram. Launch dates for the Medicaid EHR Incentive Program vary by state, so the earliest date attestation can begin also varies by state. Several states have disbursed incentive payments as early as April 2011.

The Payment Process

CMS will issue incentive payments in the same manner that providers receive payments for Medicare services, via electronic funds transfer or check. Payments will be made to the taxpayer identification number (TIN) selected during registration for the Medicare EHR Incentive Program.

Attesting to Meaningful Use After 2012

The EHR Incentive program is being unfolded three phases. Phase I lasts through the end of 2012. Phase II begins in 2013 and ends in 2014. Phase III runs from 2015-2016.

Both Phase II and Phase III will introduce new requirements for demonstrating meaningful use. When the requirements, which are still in develop- ment, are finalized, it will mean that EHR vendors will need to re-certify their products in order to comply. Similarly, the standards for providers to demonstrate meaningful use will change accordingly.

As such, to claim your maximum share of the financial incentives in the years to come, it is crucial that your vendor be committed both to EHR re-certification and to training your staff in the use of any new functionalities needed to meet new meaningful use requirements. With an EHR, particularly one being adopted to achieve meaningful use, vendor support is as important as the system itself. Choose a vendor with a track record of delivering it