Urgent message: There are serious and costly consequences for misclassifying employees as independent contractors, even if the employee requests or agrees to do so.

Alan A. Ayers, MBA, MAcc is Chief Executive Officer of Velocity Urgent Care.

With COVID-19 fears or childcare issues requiring more people to consider home-based employment—and with many companies already conditioned to having employees working remotely—circumstances may arise in which executive or administrative personnel seek job flexibility beyond what’s currently offered to employees by converting these positions to off-site “independent contractor” status.

Of course, there is no way that this would be feasible in with clinic-based or frontline urgent care personnel—such as receptionists, physicians, nurse practitioners, x-ray technicians, and medical assistants—whose positions require them to be physically present at a site of care. However, an urgent care operator might consider remote workers in areas like billing and accounting, human resources, IT, and other administrative support functions that don’t interact with the public (but do interact with other employees).

This article will look at what constitutes an independent contractor vs and an employee, as well as the issues of reclassifying an employee to an independent contractor.

What’s the Difference Between an Employee and an Independent Contractor?

As early as 1941, the term “independent contractor” was used to describe a person who did work for an employer but wasn’t an employee.1,2

For example, courts in the Fifth Circuit use “the economic reality test” to determine whether there’s an employer/employee relationship.3,4 Courts applying this test consider “whether the putative employer: (1) possessed the power to hire and fire the employees; (2) supervised and controlled employee work schedules or conditions of employment; (3) determined the rate and method of payment; and (4) maintained employment records.”5-7

Courts have noted that neither the subjective intent of the worker and employer nor the label they use to describe their relationship is determinative on the issue of whether the worker is an employee or an independent contractor.8,9

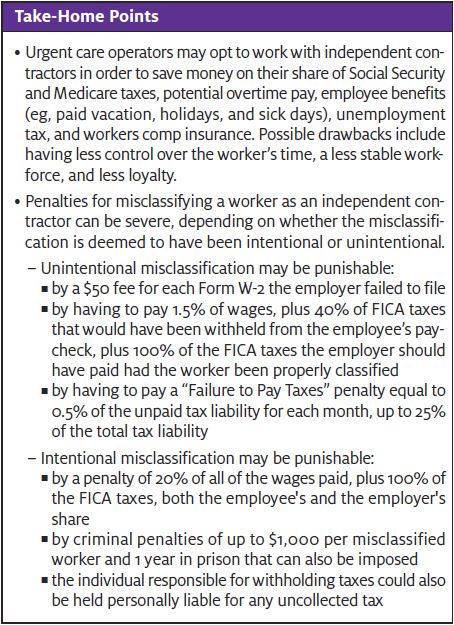

Employees are typically much more expensive for employers than independent contractors. The employer is required to withhold federal income tax and FICA taxes on the employee’s wages, as well as pay the employer’s share of FICA taxes and the FUTA tax, state taxes, and workers compensation premiums. Further, employees may be entitled to unpaid family leave under federal law, health insurance under the Affordable Care Act, and the protection of a numerous discrimination laws. There also may be other state law protections. For example, 13 states and the District of Columbia have enacted laws to require paid sick leave.10

These benefits and protections don’t apply to independent contractors. As such, there’s a strong financial motivation for employers to prefer them. However, that savings is weighed against employer control, employee loyalty, and workforce stability.

The primary reason that employers misclassify employees is indeed money. An employer can eliminate a number of expenses by classifying a worker as an independent contractor instead of an employee. These include the employer’s share of Social Security and Medicare taxes; overtime pay; employee benefits, including vacation, holiday, and sick pay; unemployment compensation tax; and workers compensation insurance.11

That said, there are severe penalties for misclassifying workers as independent contractors.12,13

What are the Consequences of Misclassifying a Worker?

State and federal governments take the issue of misclassification very seriously. There are adverse implications for misclassifying a worker as an independent contractor. The threshold question is whether the misclassification was intentional or not.

Unintentional misclassification

If the misclassification was unintentional, the employer is subject to, at a minimum, the following penalties, based on the fact that all payments to misclassified independent contractors have been reclassified as wages:

- $50 for each Form W-2 that the employer failed to file because of classifying workers as an independent contractor

- Because the employer did not withhold income taxes, it faces penalties of 1.5% of the wages, plus 40% of the FICA taxes (Social Security and Medicare) that weren’t withheld from the employee, along with 100% of the matching FICA taxes the employer should have paid

- A Failure to Pay Taxes penalty that’s equal to 0.5% of the unpaid tax liability for each month up to 25% of the total tax liability11

Intentional misclassification

If the Internal Revenue Service suspects fraud or intentional misconduct, the agency can impose additional fines and penalties.

For example, the employer may be subject to penalties of 20% of all of the wages paid, plus 100% of the FICA taxes, both the employee’s and the employer’s share.14

In addition, there are criminal penalties of up to $1,000 per misclassified worker and 1 year in prison that can also be imposed. The individual responsible for withholding taxes could also be held personally liable for any uncollected tax.14

States are also enacting their own penalties for misclassification. For example, as of July 1, 2020 Virginia law prohibits employers from entering into, enforcing, or threatening to enforce a covenant not to compete with so-called “low wage” employees. This includes, inter alia, independent contractors who are paid at an hourly rate less than the median hourly wage for the Commonwealth.15 In addition, the new statute permits an individual who has not been properly classified as an employee to bring a civil action for damages against the employer if it had knowledge of the individual’s misclassification.15,16

Likewise, in 2019, California Governor Gavin Newsom signed a new law that imposes a tighter standard for classifying a worker as an independent contractor. This new standard is named “the Dynamex standard,” which codifies and expands a 2018 California Supreme Court decision.17 The new test, like that of Virginia, presumptively considers all workers to be employees, and allows workers to be classified as independent contractors only if the employer demonstrates that the worker satisfies each of three conditions:

- that the worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of the work and in fact

- that the worker performs work that is outside the usual course of the hiring entity’s business

- that the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed17

As a result of the new statute and the Dynamex standard, many workers in the state will now be classified as employees rather than as independent contractors.17

This increased scrutiny from government agencies—such as the IRS, the Department of Labor, and state employment and taxation departments—and a more frequent use of independent contractors has resulted in an increased risk of an audit for worker misclassification.18 Some common audit triggers include:

- An independent contractor filing a compensation or disability claim

- An independent contractor filing for unemployment compensation

- An employee whistleblower reporting misclassification

- An individual who is under dual classification19

Takeaway

A 2009 study by the Treasury Inspector General estimated that misclassification costs the United States $54 billion in underpayment of employment taxes and $15 billion in unpaid FICA and unemployment taxes annually.20

Make certain that your urgent care operation has classified its workers correctly—or face significant penalties.

(For additional information and context regarding this subject, see Which Way to Go: The Pros and Cons of 1099 vs W-2 Income for Urgent Care Physicians, available at: jucm.com/which-way-to-go-the-pros-and-cons-of-1099-vs-w-2-income-for-urgent-care-physicians/.)

References

- Lowman v Unemployment Comp. Bd. of Review, No. 41 EAP 2018, 2020 Pa. LEXIS 3935, at *37 n.22 (July 24, 2020).

2. See Shu-Yi Oei* & Diane M. Ring, Tax Law’s Workplace Shift, 100 B.U.L. Rev. 651 (March 2020).

3. Gray v Powers, 673 F.3d 352, 354 (5th Cir. 2012).

4. See also U.S. Department of Labor, Wage & Hour Division, Fact Sheet 13: Employment Relationship Under the Fair Labor Standards Act (FLSA) (Revised July 2008). Available at: https://www.dol.gov/agencies/whd/fact-sheets/13-flsa-employment-relationship

5. Williams v Henagan, 595 F.3d 610, 620 (5th Cir. 2010).

6. See Rutherford Food Corp. v McComb, 331 U.S. 722, 729, 67 S. Ct. 1473, 91 L. Ed. 1772 (1947).

7. See John A. Pearce II and Jonathan P. Silva, The Future of Independent Contractors and Their Status as Non-Employees: Moving on from a Common Law Standard, 14 Hastings Bus. L.J. (Winter, 2018).

8. Valenzuela v Trinity Thru Tubing, LLC, No. 4:18-02244, 2020 U.S. Dist. LEXIS 127814, at *7 (S.D. Tex. July 21, 2020).

9. See Berry v Fun Time Pool & Spa, Inc., No. 2:20-cv-1610, 2020 U.S. Dist. LEXIS 127144, at *2-3 (S.D. Ohio July 20, 2020).

10. National Conference of State Legislatures, Paid Sick Leave (July 21, 2020). Available at: https://www.ncsl.org/research/labor-and-employment/paid-sick-leave.aspx.

11. JustWorks, Improperly Classifying Employees as Independent Contractors: The Penalties (December 28, 2017). Available at: https://justworks.com/blog/consequences-misclassifying-workers-independent-contractors.

12. Anne Wallace, Can I Reduce Costs by Reclassifying Employees as Independent Contractors? Pasha Law (February 5, 2015). Available at: https://www.pashalaw.com/reduce-costs-reclassifying-employees-independent-contractors/.

13. See U.S. Department of Labor, Wage & Hour Division, Misclassification of Employees as Independent Contractors. Available at: https://www.dol.gov/agencies/whd/flsa/misclassification.

14. See, eg, Am. Family Life Assurance Co. v.] Hubbard, No. 4:17-CV-246 (CDL), 2018 U.S. Dist. LEXIS 700, at *9 (M.D. Ga. Jan. 3, 2018).

15. Virginia Acts of Assembly, H330 (2020). Available at: https://lis.virginia.gov/cgi-bin/legp604.exe?201+ful+HB330ER+pdf, to be codified at Va. Code § 40.1-28.7:7.

16.Virginia Code §. 58.1-1901, effective January 1, 2021.

17. Dynamex Operations W. v Superior Court, 4 Cal. 5th 903, 955-56, 232 Cal. Rptr. 3d 1, 41, 416 P.3d 1, 34 (Cal. 2018).

18. How to Avoid a Misclassification Audit.MBO Partners (March 6, 2020). Available at: https://www.mbopartners.com/blog/misclassification-compliance/how-to-avoid-an-independent-contractor-misclassification-audit/.

19. Matthews A. 15 Best practices for classifying workers and avoiding an audit. MBO Partners. August 11, 2015. Available at: https://www.mbopartners.com/blog/misclassification-compliance/independent-contractor-audit-guide1/.

20. Oregon Center for Public Policy. The wage theft crisis.Available at: https://www.ocpp.org/2011/Wage%20theft%20fact%20sheet%203.17.11.pdf.