Urgent message: Urgent care operators of all sizes are poised for continued growth in 2023. In this post-COVID environment, look to shifting de novo ownership trends, a slowing of health system activity, and independent entrepreneurs regaining their courage as the driving factors.

Alan A. Ayers, MBA, MAcc

The COVID-19 pandemic is no longer the primary driver of decision-making for urgent care operators. While its impact over the past few years cannot be understated, other factors are now responsible for propelling the industry forward.

Operators continue to seek new ways of connecting with patients beyond upper respiratory visits in suburban settings. Moreover, widespread challenges facing the healthcare industry are once again changing the landscape of urgent care ownership.

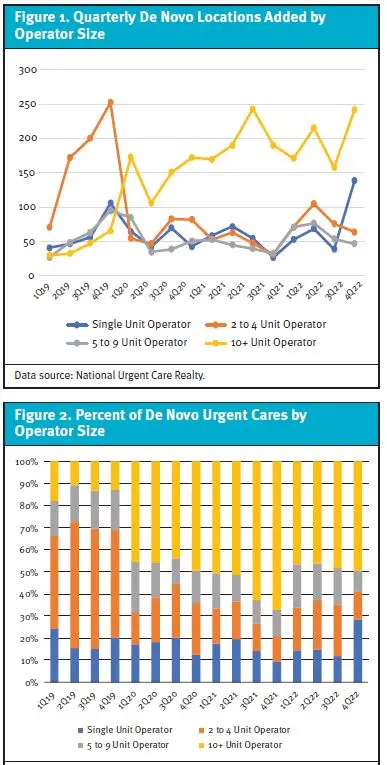

Despite these challenges, urgent care is poised for another year of growth in 2023. However, a look at the data shows how the growth engine has evolved since 2020. Today, operators with 10+ units represent nearly 50% of new rooftops. This segment has been growing consistently due to strong financials and private equity funding, allowing these centers to thrive throughout the pandemic and capitalize on increased volumes.

Meanwhile, as the industry sees slowed activity by health systems, independent operators will have plenty of opportunities to differentiate themselves from the competition by focusing on new populations, new payers, and new services.

As normalcy returns and the healthcare industry’s familiar challenges reclaim center stage from the COVID-19 pandemic, urgent care will continue to adapt with growth forecast for 2023.

Opportunities for Growth at All Scales

Before the pandemic, urgent care’s growth engine was the 2- to 4-center operator. With many operators opening a second location and settling happily into “growth mode,” this segment accounted for the majority of new rooftops added.

But the pandemic brought about many changes starting in 2020. Though COVID-19 would eventually lead to a surge in demand for testing, vaccination, and treatment services, uncertainty over patient volumes forced many operators to the sidelines. Independent providers with fewer than nine centers faced several key barriers during the pandemic.

Widespread staffing challenges, shortages in key roles like medical assistants and radiology technologists , and wage inflation all made navigating the day-to-day aspects of business more challenging. Meanwhile, a swarm of merger-and-acquisition activity capitalized on many smaller operators’ desire to sell their businesses while high on revenues from COVID’s record volumes. As a result, 2020 saw a shift in the main driver of urgent care growth from entrepreneurial ownership to corporate models. The first quarter of 2020 saw 10+ unit operators add the most de novo locations of any type of center(see Figure 1 and Figure 2). As of the fourth quarter of 2022, 10+ unit operators remained the segment with the highest number of de novo locations added.

The consistency of this segment can partially be attributed to the influence of private equity investors and fully funded 3- to 5-five-year investment horizons. As smaller operators took a step back to evaluate the pandemic’s effects, 10+ unit operators were strongly positioned to capitalize on increased volumes. Indeed, the level of demand allowed new centers to break even almost immediately after opening.1

The 10+ unit operator segment’s growth over the past 2 years means it persists as the primary growth engine for urgent care. However, as pandemic fears wane and entrepreneurs regain their courage, this trend could be due for a change.

The final quarter of 2022 saw a large spike in single-unit operator de novo locations, from 12% to 28% of all openings (see Figures 1 and 2). Notably, this share is reminiscent of Q1 2019 when single-site operator de novo centers accounted for 24% of the total.

Despite the challenges of soaring interest rates, inflation, and operating costs, single-site physician owner-operators are still the backbone of the urgent care industry. As the world continues to trek back toward normalcy, the industry should be encouraged by entrepreneurs opening new urgent care centers both independently and with franchising.

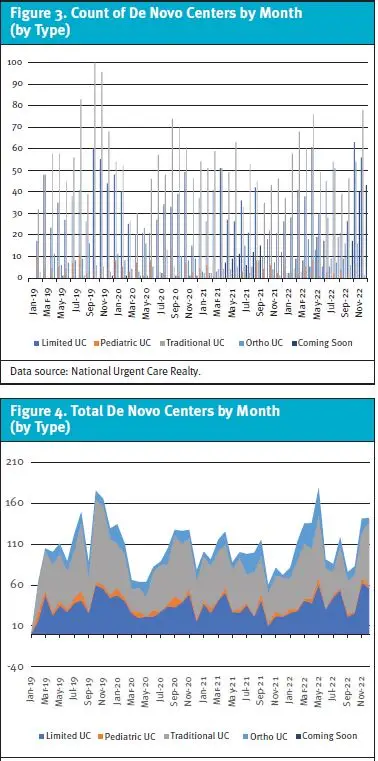

These centers follow the opposite trajectory of freestanding or remote emergency rooms and retail clinics, which have all experienced a decline in de novo center openings.

These data suggests “traditional urgent care” (ie, those centers meeting the criteria set forth by the Urgent Care Association2), is the preferred operating model of providers, patients, and payers. The combination of flexible hours and efficient, accessible services continues to be a winning strategy.

Meanwhile, we also saw renewed growth in the limited urgent care segment to close out 2022 (see Figures 3 and 4). This reflects the operating changes made by many centers in the wake of COVID-19. Limited urgent care centers are unable to meet all UCA certification criteria, often due to external limitations. For instance, offering fewer opening hours due to demand constraints in the center’s geography or eliminating x-ray services due to a testing focus or staffing issues, can land centers in the limited category.

The distinction between “traditional” and “limited” urgent care can explain variances in the numbers of centers reported by UCA and other publications or resources. Including limited centers—those which offer “urgent care medicine” but fail to meet all UCA criteria—simply expands the industry’s umbrella and more accurately depicts the number of sites holding themselves out as “urgent care.”

Health System Troubles Slow Hospital Urgent Care Growth

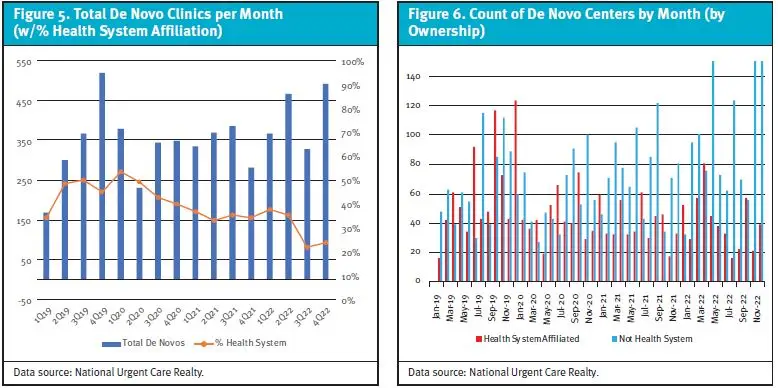

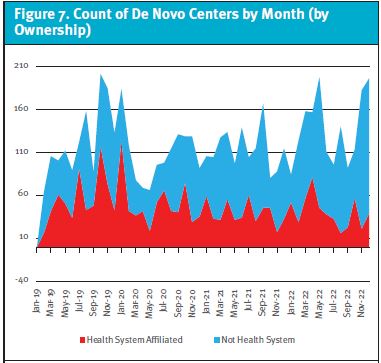

As the wider urgent care industry has seen robust growth over the past few years, one segment has slowed significantly: health system-affiliated centers. The total percentage of de novo clinics with a health system affiliation has plummeted by half, from a peak of 50% in Q3 2019 to 24% in Q4 2022 (see Figure 5).

So, who or what is to blame for this drastic change? The ongoing financial pressure on hospitals and healthcare systems bears much of the responsibility.

Going into 2023, there is no relief in sight for hospitals’ heightened baseline labor cost, lofty inflation, and growing fears of a recession.3 Adding to the struggle are rate increases from payers failing to match higher expenses and inflation as well as hospitals being forced to sell market investments at a loss to generate sufficient cash flow.

As a result, healthcare systems cannot prioritize expansions into areas like new urgent care facilities or partnerships. However, the sharp decrease in de novo centers with health system affiliations opens the door for entrepreneurs and smaller groups to own and operate new centers. The final quarter of 2022 saw nearly 105% more de novo clinics not owned by a health system than those with an affiliation (see Figure 6 and Figure 7).

Continued Growth with More Centers on the Way

While the number of de novo centers across segments is encouraging, one number stands above the rest. Over the fourth quarter of 2022, “coming soon” centers accounted for over 20% of all de novos (see Figures 3 and 4).

This represents a robust pipeline of new centers heading into 2023. Unforeseen circumstances excluded, the data indicate urgent care’s current growth trend will likely continue well into this year.

Conclusion

While the COVID-19 pandemic has impacted our industry significantly over the past few years, new factors are now driving urgent care forward. Although the traits of de novo urgent care centers in 2023 look far different than the prepandemic landscape, there are plenty of growth opportunities.

As the industry shifts away from healthcare system affiliations, physician owner-operators and 10+ unit operators alike can tap into the growing demand for urgent care services and differentiate themselves by targeting new populations, geographies, and community needs. The diversity and flexibility of the urgent care model will continue to adapt to meet the changing demands of the healthcare industry and provide growth opportunities at all scales.

References

- Ayers AA. As covid turns endemic, investors remain bullish on urgent care growth. J Urgent Care Med. 2022;16(10):35-39.

- Urgent Care Association. Certification criteria. Available at: https://urgentcareassociation.org/quality/certification/certification-criteria/. Accessed February 6, 2023.

- Thomas N. Hospital sector will face sustained challenges in 2023; bankruptcies likely: 5 things to know. Becker’s Hospital CFO Report. January 13, 2023. Available at: www.beckershospitalreview.com/finance/hospital-sector-will-face-sustained-challenges-in-2023-bankruptcies-likely-5-things-to-know.html. Accessed February 6, 2023.

Author affiliations: Alan A. Ayers, MBA, MAcc is President of Experity Consulting and is Practice Management Editor of The Journal of Urgent Care Medicine. The author has no relevant financial relationships with any commercial interests.

Read More

- DOT Physicals And Urine Drug Testing Represent A Growth Opportunity For Urgent Care Centers

- Find Prime Locations For Rapid Urgent Care Growth